Eurozone business activity expanded faster than expected in March, driven by growth in the dominant services sector, indicating that an economic rebound from last year’s energy crisis remains on track.

A survey of purchasing managers published by S&P Global on Friday pointed to an easing of supply constraints, lower input price pressures and an acceleration of jobs growth, although companies also expressed concern about banking stress and higher borrowing costs.

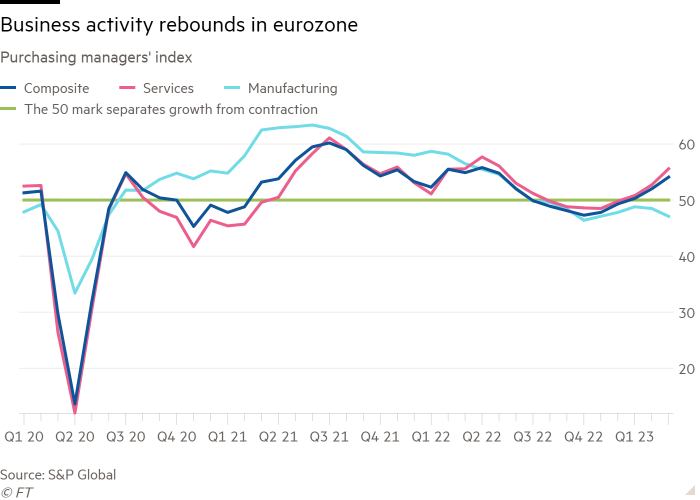

The flash eurozone composite purchasing managers’ index, a measure of activity in manufacturing and services, rose for the fifth consecutive month to a 10-month high of 54.1 in March, up from 52 in the previous month and higher than the reading of 51.9 expected by economists.

The result was based on responses collected between March 10 and March 22, with the impact on confidence of the banking turmoil that resulted in the rescue takeover of Credit Suisse by rival UBS only partially accounted for.

It was also above the 50 mark for the third month in a row, meaning a majority of businesses in the 20-country bloc reported an increase in their activity from the previous month.

“Growth has been buoyed since the lows of late last year as recession fears and energy market worries fade,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

However, he added that “stubborn inflationary pressures” indicated “more work may be needed in terms of bringing inflation down to target”.

The resilient performance of the eurozone economy has boosted demand and kept price pressures elevated, contributing to the European Central Bank’s decision to raise interest rates by half a percentage point last week.

The survey found a “steep rise” in input costs at services companies due to rising wages, while industrial input prices fell for the first time since July 2020, reflecting improved supply chains and lower demand.

Average selling prices “continued to rise sharply”, as companies passed on more of their higher costs to customers — although the rate slowed to its lowest since May 2021.

“Continued fast price increases, a still-resilient labour market and signs the economy is weathering interest rate hikes well so far, will bolster ECB hawks’ calls for the bank to continue on its steep tightening path, despite wobbles in the banking sector,” said Melanie Debono, an economist at research group Pantheon Macroeconomics.

The PMI results highlighted a contrast between the improved outlook of services companies and a sharper-than-expected downturn in manufacturing. The PMI score for the services sector hit a 10-month high, while the reading for manufacturing fell to a four-month low.

Employment growth rose to a nine-month high, driven by a pick-up in hiring at services companies. Business confidence about the year ahead dipped from February’s 12-month high, which S&P Global said “could be in part traced to concerns over uncertainty caused by recent banking sector stress and the potential impact of further interest rate hikes”.

Franziska Palmas, an economist at research group Capital Economics, said she still expected a eurozone recession later this year as higher interest rates hit demand, but added that a rebound in new orders recorded by the PMI survey “suggests it may take a bit longer than we anticipated for that weakening to occur”.

Growth picked up in financial services and the real estate sector, as well as in consumer services, such as travel and tourism. There was also higher activity in the industrial services, IT and healthcare sectors.

Stronger growth in the automotive sector, helped by easing supply constraints, was a rare bright spot amid broad stagnation in the manufacturing sector, where new orders have fallen for 11 consecutive months.