This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

Welcome back to Energy Source.

As oil prices slid in recent weeks, an aversion to hedging left many players in the US shale patch exposed, as Justin reports this morning.

But has the price rout now ended, or is there more pain to come? In today’s newsletter, Derek asks if oil prices are about to rebound.

Christine Murray reports from Mexico on warming relations between the government and private capital, after a deal was struck to push forward development of a major new oilfield. And Amanda reports on where oil workers see their future.

Thanks for reading — Myles

The crude comeback . . .

Crude prices jumped yesterday, with Brent settling up 4 per cent at $78.12 a barrel amid hopes that the banking crisis that has rattled global markets has begun to ease.

The loss of about 5 per cent of global supplies as exports from northern Iraq to Turkey were shut was more bullish news for crude.

So is that it for the March madness in oil markets? The short answer is no. Brent is still about $8 below its price from the day before Silicon Valley Bank’s troubles went public. And speculators remain bearish.

Net long positions in major crude contracts as a share of open interest in the market have more than halved in recent weeks, representing just 5 per cent. That’s lower than at any point since oil prices went sub-zero in April 2020, noted Rory Johnston at Commodity Context. The sheer scale of the change in speculators’ position in recent weeks, noted the ever-astute Reuters analyst John Kemp, implies a “fundamental change in the outlook”.

SVB’s failure, Credit Suisse’s demise and the fear of further contagion have alarmed even the most bullish analysts. Goldman Sachs cited banking stress, recession fears, and surging volatility as it slashed its Brent price forecast for 2023 by $7/b, to $85/b.

“Historically, after such scarring events, positioning and prices recover only gradually,” the bank said.

The tightening of credit conditions is also weighing on an oil market always fearful of recession risk, noted analysts at Energy Aspects. It’s no repeat of 2008, “But funding costs for US regional banks will rise to compete for deposits, which will squeeze net interest margins, tightening the credit cycle and slowing the economy.”

In the background are sloppy global supply and demand fundamentals. Russian supply has not fallen as steeply as expected, and Chinese demand has not picked up as quickly as forecast. Strikes at French refineries have weakened crude consumption; the US government is holding off buying oil for the Strategic Petroleum Reserve; and rich world commercial oil inventories are rising quickly. Opec shows little inclination of stepping in until it better understands the outlook, noted Energy Aspects.

And yet, if anything, the price drop of recent weeks only enhances the chances of a strong recovery later.

Russian supply may have proved resilient so far. But the absence of western capital in the upstream will eventually erode capacity. Meanwhile, the Kremlin last week said it was about to enforce a unilateral cut of about 5 per cent of supply.

Although China’s demand has underperformed expectations, that seems unlikely to last much longer. The International Energy Agency said this month that a “resurgent China” would help push global oil demand up between the first and fourth quarters this year by 3.2mn barrels a day, “the largest relative in-year increase since 2010”.

The recent price drop, meanwhile, has exposed even more frailties in the shale patch, where high costs and capital restraint were already creating headwinds for significant supply growth.

In short, the oil price rout this month has, if anything, probably only delayed a reckoning to come later in the year, when the world’s consumers are expected to burn record amounts of crude again.

To be sure, a global recession would destroy this bullish thesis — and warnings from the World Bank of a “lost decade of growth” to come will hardly steel the nerves of some oil traders. Until the banking problems are decisively resolved, the macro threats will loom over crude prices.

Oil markets have turned “excessively pessimistic”, noted Goldman, ever the bull. But it has a point. If recession is averted, the recovery in oil prices could be swift. The trading strategies and position-covering moves that triggered such volatility on the way down could be just as violent on the way up.

(Derek Brower)

Detente between Mexico and private oil investment

Mexico’s fraught relationship with private sector energy investment seems to be thawing.

That is the main takeaway from the breakthrough deal struck between state oil company Pemex and a private sector consortium to develop the massive Zama oilfield.

The project in 2017 became Mexico’s first big private sector oil discovery in three-quarters of a century after a landmark 2013 reform that threw the doors open to private capital.

But a stand-off between the consortium and Pemex, which owns some of the acreage on which it is situated, prompted a drawn out battle over who should be in charge — making it a test case for foreign investment under president Andrés Manuel López Obrador.

Last Thursday, Pemex and the consortium of companies led by US group Talos Energy said they had submitted a joint plan to hydrocarbons regulator CNH to develop the field, which could produce up to 180,000 barrels per day, equivalent to 10 per cent of the country’s oil production.

“It’s huge news,” said John Padilla, managing director at IPD Latin America. “It’s indicative of the fact that there is a willingness, within the constraints of the administration, to move good things forward.”

López Obrador, who took power in 2018, is an old-school energy nationalist who has upended the country’s oil and gas industry. He has effectively reversed parts of the 2013 reform stalling new investment in the sector.

In 2021, his government handed control of Zama to Pemex. Talos, which says it has invested more than $100mn in the field, filed notices of dispute under the United States-Mexico-Canada free trade agreement (USMCA).

Under last week’s agreement, Pemex will retain 50.4 per cent of participating interests, with Talos holding 17.4 per cent, Germany’s Wintershall DEA 19.8 per cent and Harbour Energy of the UK 12.4 per cent.

The market is still dramatically changed from the broader opening for investment under the prior administration, and new projects have to align with López Obrador’s vision to complement the state companies rather than compete with them.

Still, the Zama agreement is the latest sign that his government is now allowing a limited number of large deals in the energy sector to move forward, particularly in the form of joint ventures.

-

In November Pemex said it would develop the Lakach deepwater natural gasfield with US company New Fortress Energy.

-

In February, US company Sempra and billionaire Carlos Slim’s Grupo Carso signed a memorandum of understanding with electricity utility CFE to work on a new natural gas pipeline in north-west Mexico.

-

TransCanada signed a deal with CFE last year to jointly build an offshore natural gas pipeline in the south-east.

Experts said reality was catching up with the government. Pemex’s production has dropped to historic lows of about 1.8mn barrels per day and the heavily indebted company faced more than $5bn of debt repayments in just the first quarter.

“Today is a better moment than two or three years ago,” said Ramón Massieu Arrojo, an energy lawyer who was general counsel for regulator CNH until the end of 2020. “Things are going to get better, not change radically, but they will get better in the next two years and without a doubt in the next administration whoever becomes president.”

(Christine Murray)

Data Drill

With the energy transition under way, a looming question faces oil and gas workers: what will happen to their jobs?

A new report by True Transition surveyed more than 1,600 oil and gas workers on their outlook for the industry and their future employment. More than half of them supported federal action to guarantee jobs to those displaced by the transition, and 42 per cent supported subsidised training in a new field.

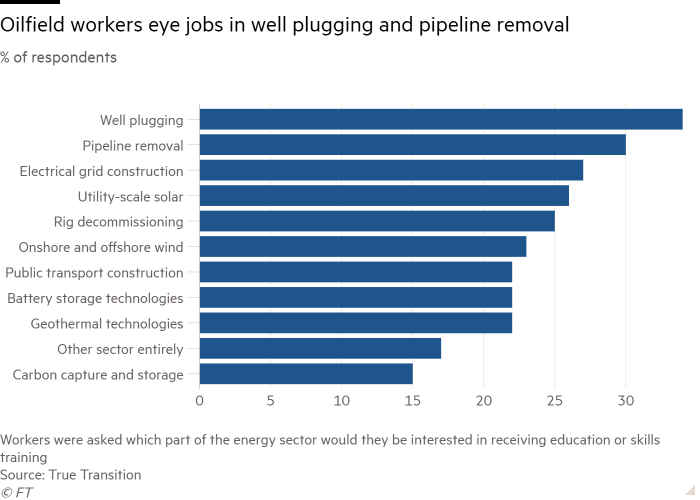

The survey comes as the Biden administration seeks to spark a boom in clean energy jobs. Yet when it comes to new sectors in the energy industry, workers preferred jobs requiring similar expertise such as well-plugging and pipeline removal. Jobs in grid electrification and utility solar were also among the top choices, however, with more than a quarter of respondents reporting interest in training for these fields. (Amanda Chu)

Power Points

Energy Source is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Reach us at energy.source@ft.com and follow us on Twitter at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here